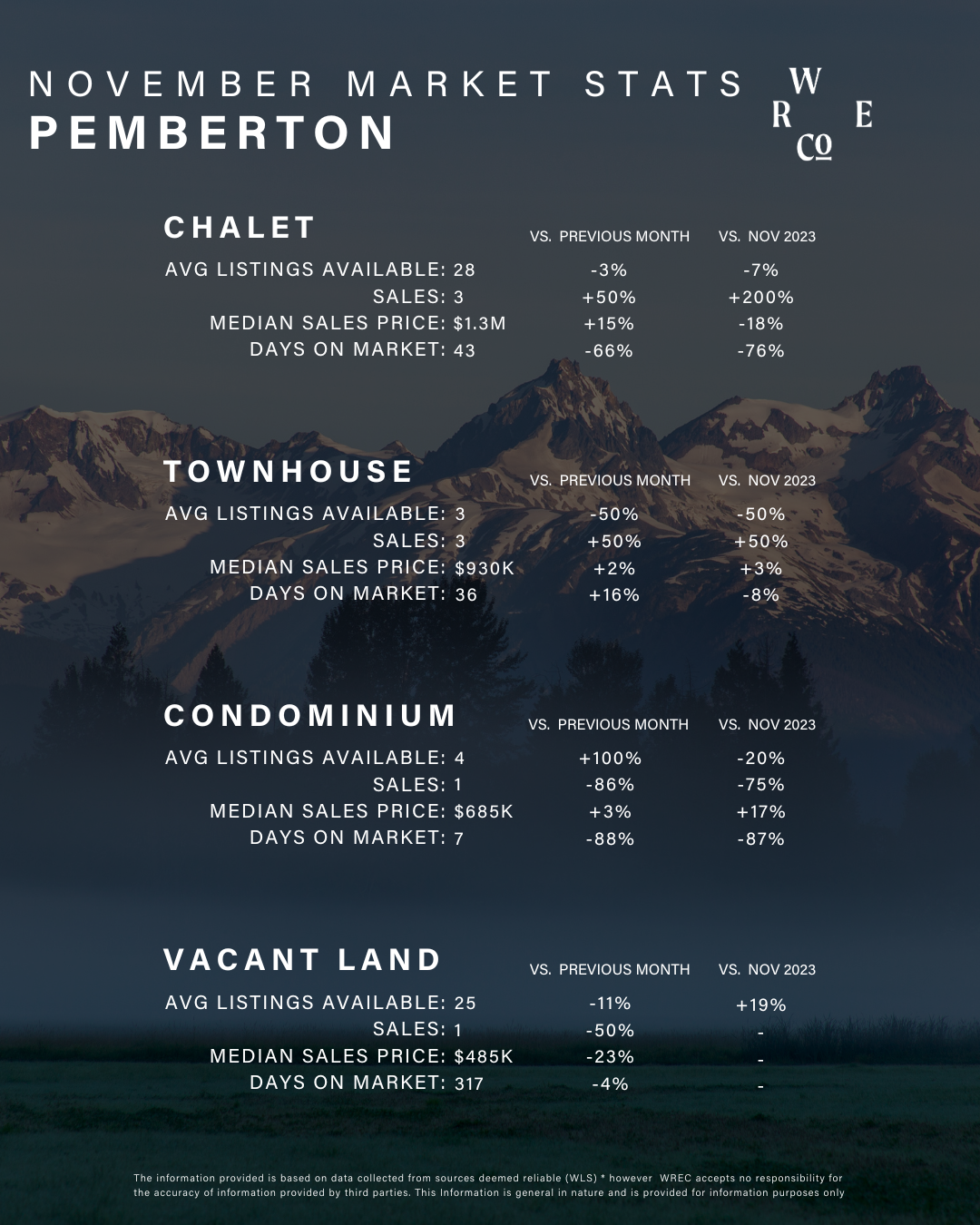

In Pemberton, November saw eight property sales, aligning with both the monthly average for 2024 and the same period last year. The sales comprised three single-family homes, three townhouses, and one condo. Overall inventory stood at 64 units, a 16% decrease from the previous month, with 39 units excluding vacant land. Median sales prices experienced a slight uptick across all categories compared to October. The median days on market dropped significantly year-over-year, with single-family homes at 43 days and condos at seven days. These trends are influenced by cumulative interest rate decreases. The condo and townhouse segments favor sellers, while the single-family market leans toward buyers.

Provincially, the British Columbia Real Estate Association (BCREA) forecasts a 2.6% increase in MLS® residential sales for 2024, totaling 75,000 units. This growth is expected to continue into 2025, with a projected 13% rise to 84,500 units. The BCREA attributes this momentum to improving market conditions following two challenging years.

In Greater Vancouver, the average home price in November 2024 was $1,276,716, marking a 0.5% annual decrease but a 2.1% monthly increase. The benchmark price stood at $1,172,100, down 0.9% year-over-year. Detached homes had an average price of $2.16 million, a 1.7% annual increase, while condos averaged $785,179, a 1.1% decrease from the previous year.

Economically, with inflation within the target range and interest rate reductions, there's potential for Canada's real estate markets to rebound after two years of slow growth. A possible further interest rate decrease on December 11 could stimulate more activity in markets like Pemberton.

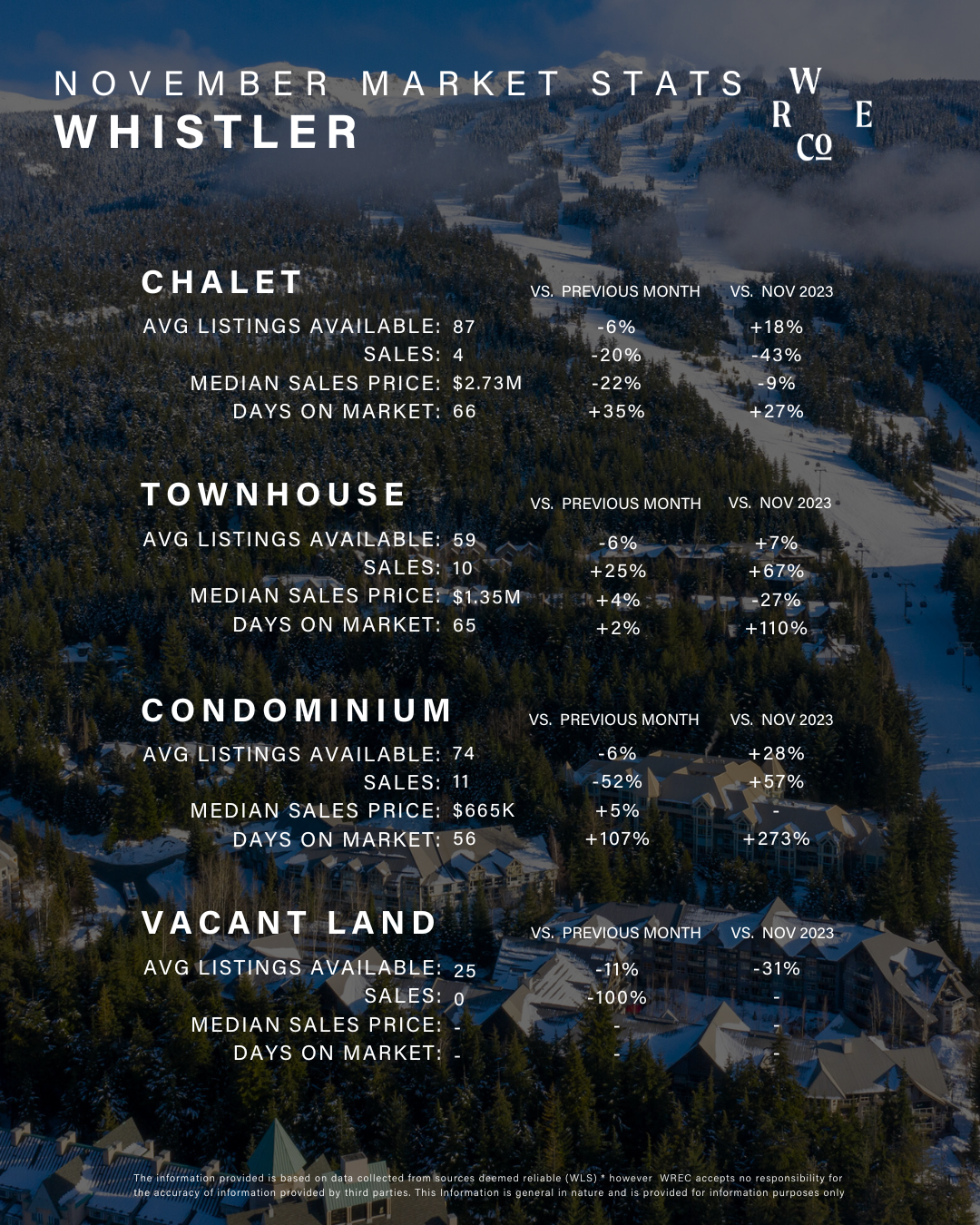

Looking ahead, a seasonal slowdown in sales is anticipated for December. However, early snowfall in Whistler may boost activity during this typically quieter period. Additionally, the anticipated interest rate cut could further invigorate the Pemberton market.