📢 2024 Year-End Real Estate Market in Whistler & Pemberton: Trends, Surprises & What’s Next! 🏡📈

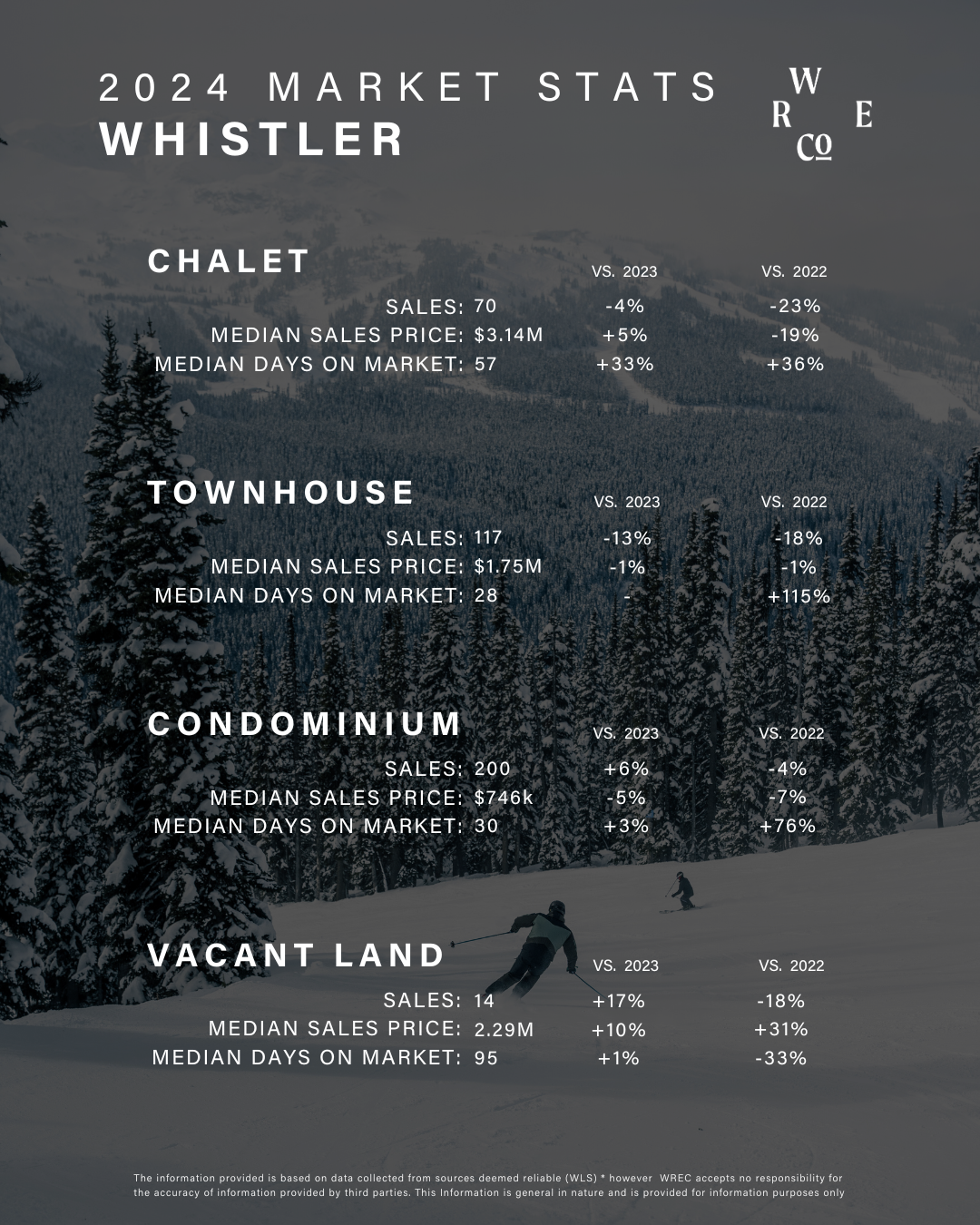

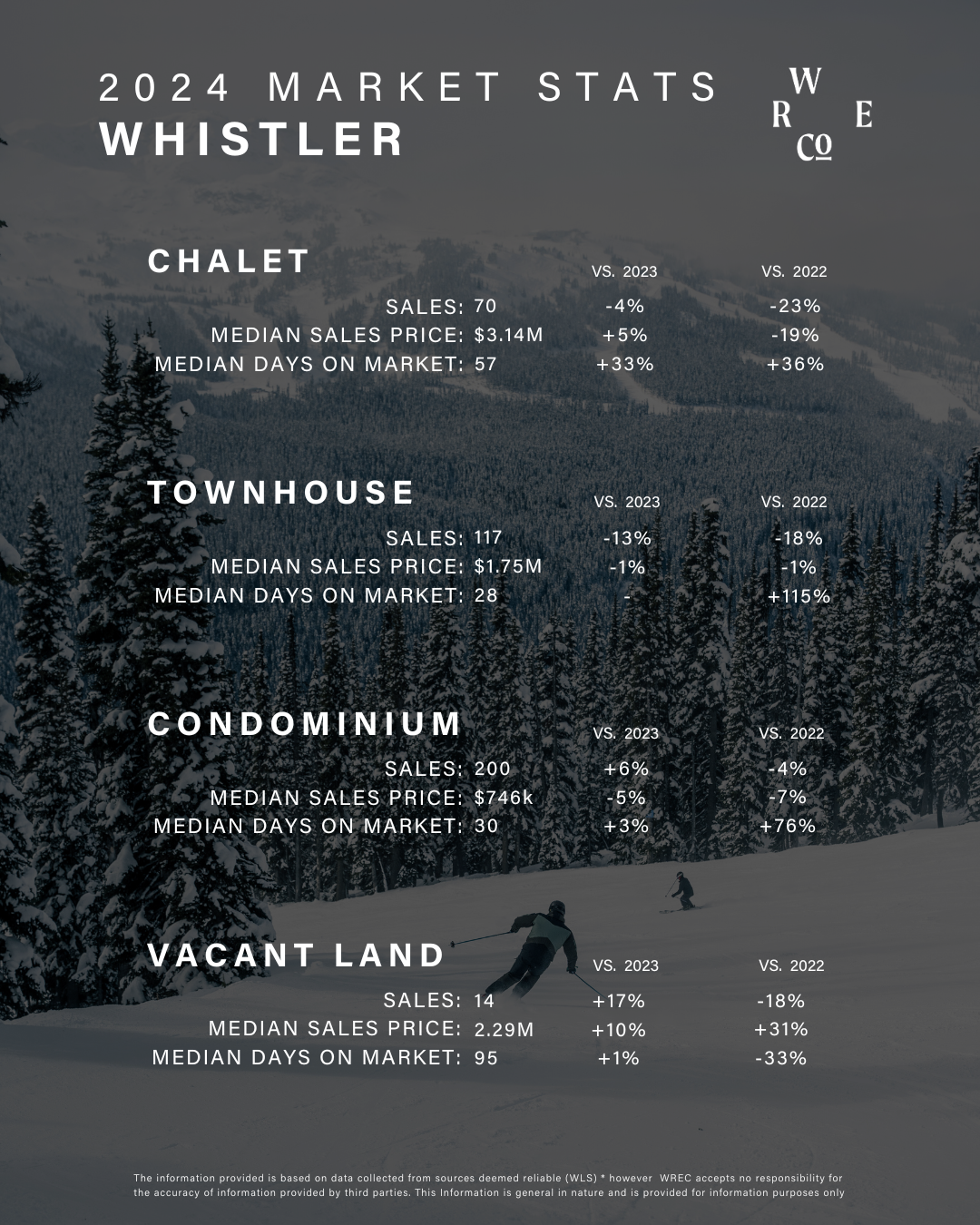

Whistler Market Overview:

Sales Volume: There were 505 sales, marking a 2% increase from 2023 but remaining 29% below the 5-year average.

Total Sales Dollar Volume: $826 million, the lowest since 2019 and 14% below the 10-year average.

Pricing: Prices remained consistent across all product categories compared to 2023.

Inventory: A total of 952 new listings were introduced, the third fewest in the last decade, with a decline in available listings in the latter half of the year.

Days on Market: Single-family properties had a median of 57 days (up from 43 in 2023); townhouses, condos, and land remained steady at 28, 30, and 95 days, respectively.

Luxury Segment: 27 sales exceeded $5 million, including a record-setting condo sale.

International Buyers: Despite Canada's foreign buyer ban, Whistler's exemption allowed international purchasers to account for approximately 13% of property acquisitions, with U.S. buyers representing 7%.

Pemberton Market Overview:

Sales Volume: 108 sales, a 6% increase from 2023.

Median Sales Price: Reached a record high of $870,000, influenced by consecutive interest rate decreases by the Bank of Canada throughout 2024.

Luxury Sales: Seven properties sold over the $2 million threshold, consistent with the previous year.

Inventory: 193 units were listed, including 39 parcels of vacant land.

Days on Market: Increased for single-family homes (53 days) and townhomes (39 days); decreased for condos (27 days) and vacant land (86 days).

Buyer Origins: 39% from Pemberton, 35% from Whistler, and 17% from the Lower Mainland.

Policy Changes and Implications:

Foreign Buyer Regulations: Whistler and Pemberton remain exempt from Canada's Foreign Buyer Ban and Foreign Buyer Tax.

Underused Housing Tax: Residential properties in these areas may be subject to this tax; property owners should consult with accountants for personalized advice.

Home Flipping Tax: Effective January 1, 2025, British Columbia introduced a tax on properties sold within 730 days of ownership, starting at 20% if sold within the first 365 days and decreasing thereafter.

Anticipated Trends for 2025:

Sales Volume: Expected to approach historical averages, supported by declining mortgage rates and policy adjustments enhancing consumer purchasing power.

Tourism and International Buyers: Favorable currency exchange rates are projected to boost tourism in the Sea-to-Sky region, potentially increasing international property purchases.

Political Developments: Upcoming elections in Canada and the U.S. may introduce policy changes affecting real estate markets.

Key Considerations for Buyers and Sellers:

Mortgage Reforms: The federal government has implemented significant changes to Canada's mortgage system, including raising the insured mortgage cap to $1.5 million and expanding access to 30-year amortizations for first-time homebuyers.

First-Time Home Buyer Incentives: Programs like the Tax-Free First Home Savings Account and enhancements to the Home Buyers’ Plan have been introduced to assist first-time buyers in saving for down payments.

Market Dynamics: While policy changes aim to improve affordability, factors such as high home prices, interest rates, and demand-supply imbalances continue to influence the market.

Prospective buyers and sellers should stay informed about these developments and consider consulting real estate professionals to navigate the evolving market landscape.

Recent Developments in Canada's Housing Market

The Whistler and Pemberton real estate markets in 2024 have shown notable trends, with Whistler experiencing a slight increase in sales and Pemberton reaching record-high median sales prices. As we move into 2025, several key policy changes and programs are set to impact homebuyers across Canada, particularly first-time buyers.

1. Enhanced Support for First-Time Homebuyers

Tax-Free First Home Savings Account (FHSA): Introduced in 2023, the FHSA allows first-time homebuyers to contribute up to $8,000 annually, with a lifetime limit of $40,000. Contributions are tax-deductible, and withdrawals for purchasing a first home are non-taxable, providing significant tax advantages.

Increased Home Buyers’ Plan (HBP) Limit: Budget 2024 raised the HBP withdrawal limit from $35,000 to $60,000. This enhancement enables first-time buyers to access up to $25,000 more from their Registered Retirement Savings Plan (RRSP) for a down payment, further easing the financial burden of purchasing a home.

2. Expanded Mortgage Amortization Periods

30-Year Amortizations for First-Time Buyers: Effective August 1, 2024, the federal government permits 30-year mortgage amortizations for first-time homebuyers purchasing newly constructed homes. This extension reduces monthly payments, making homeownership more accessible.

Broader Eligibility Starting December 15, 2024: The government expanded eligibility for 30-year amortizations to all first-time homebuyers and purchasers of new builds, regardless of prior ownership status. This policy aims to alleviate housing affordability challenges by lowering monthly mortgage obligations.

3. Increased Insured Mortgage Cap

Raised Limit: As of December 15, 2024, the cap on insured mortgages increased from $1 million to $1.5 million. This adjustment allows buyers in higher-priced markets to qualify for mortgage insurance with a minimum down payment, facilitating access to more expensive properties.

These developments are designed to support homebuyers in an evolving real estate landscape. If you're considering buying or selling property in Whistler, Pemberton, or the surrounding areas, it's crucial to understand how these changes may affect your decisions.

Understanding your property's value in the current market is essential for making informed decisions. We offer comprehensive market analyses tailored to your specific needs. Contact us today to receive an in-depth evaluation of your home's worth and to discuss how recent market trends and policy changes can influence your real estate goals.